Project Vision

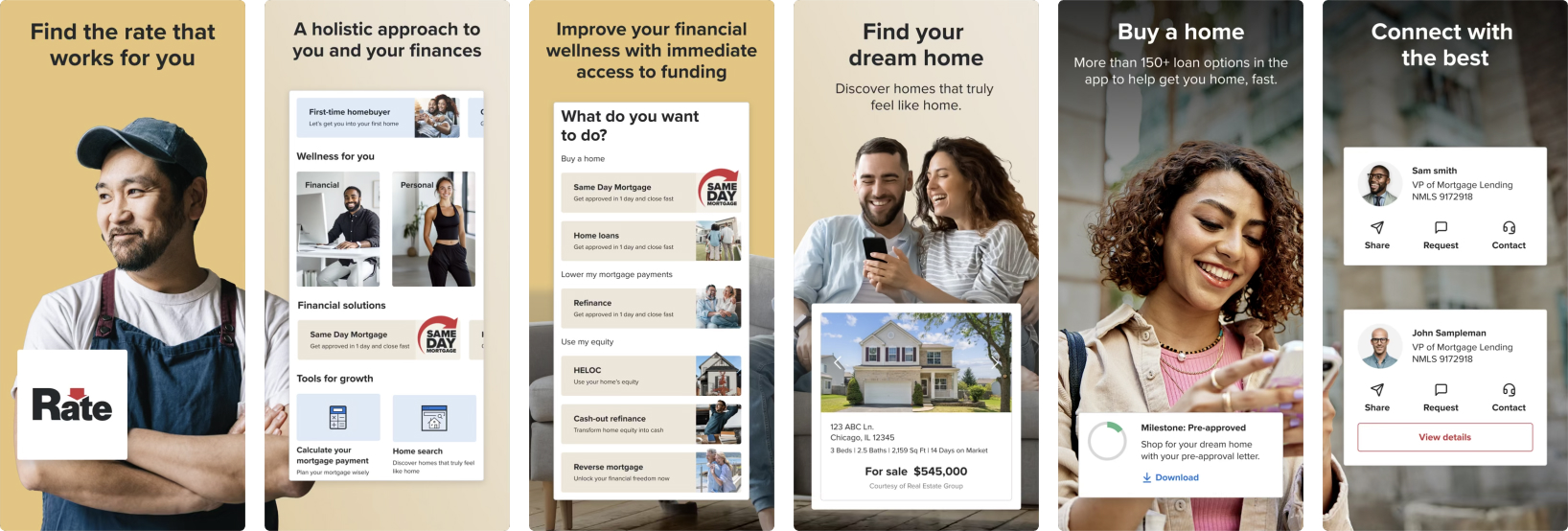

The Rate app represents a paradigm shift in financial services, moving beyond traditional mortgage and lending applications to create a comprehensive wellness ecosystem. Recognizing that financial stress deeply impacts mental and physical well-being, we designed an integrated platform that addresses the whole person, not just their financial needs.

The Challenge

Traditional mortgage and financial apps focus solely on transactions, often increasing user stress during already overwhelming life events like home buying. Research shows that 72% of Americans experience financial stress, which directly correlates with mental health issues, relationship problems, and physical health concerns. The homebuying process, in particular, ranks among life’s most stressful experiences.

The Solution

Rate is a next-generation mortgage app that blends personal and financial wellness, featuring exclusive content from Dr. Deepak Chopra alongside hundreds of fitness and wellness classes covering yoga, meditation, HIIT, strength training, breathing exercises, and nutrition.